How To Use Candlestick_ohlc To Draw A Simple Candlestick On Python

Basics of OHLC charts with Python'south Matplotlib

A quick guide on how to depict these essential charts for stock analysis

With a history going back to the 18th century, Open up-High-Low-Close (OHLC) charts are among the most pop financial analysis tools, typically used to illustrate stock prices over time.

In this article, nosotros'll see how to build an OHLC nautical chart with Matplotlib from scratch, explore the advantages and limitations of this visualization, and get a look at a more straightforward approach with mplfinance.

How does an OHLC chart work?

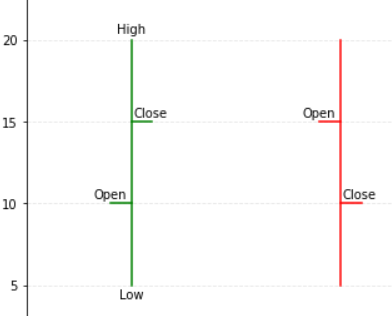

The chart is composed of a series of vertical lines that pack 4 critical variables about the price; The minimum, maximum, initial, and ending values over time, commonly measured in hours, days, or weeks.

What's the difference from a Candlestick chart?

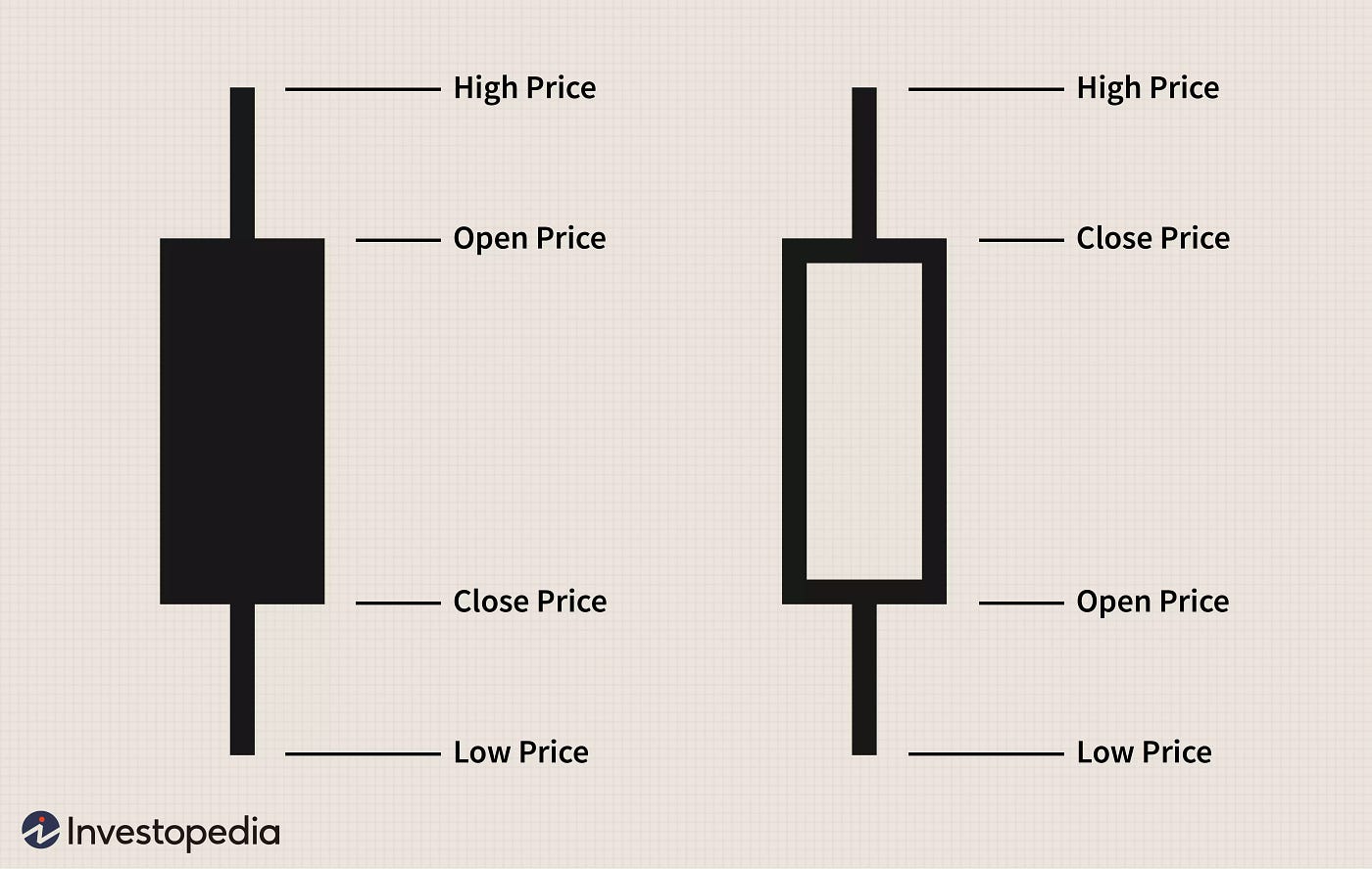

OHLC is very similar to Candlestick charts equally they both brandish the same information and are used to illustrate the toll over time. Usually of a stock, currency, bond, commodity, and others.

They slightly differ in how they display the data; OHLC open cost is always on the stick's left side and the close price on the right.

Candlesticks don't have markers on the left or correct. They take a box.

The box's filling represents the price'due south direction. Usually, a filled or red box means the price went downwards (Bearish market), so the open price is the rectangle's top part.

An empty or green box means the opposite (Bullish market), and the meridian part of the box is the closing price.

Matplotlib

Let'south start building our OHLC chart. Offset, we'll import the required libraries.

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import math The information in this example comes from a Kaggle dataset titled S&P 500 stock data.

df = pd.read_csv('../data/all_stocks_5yr.csv')

df.head()

It's an extensive dataset, and we won't be plotting all this data at once, so earlier we start, let's select a smaller subset.

# filter Apple stocks

df_apple = df[df['Name'] == 'AAPL'].copy() # convert date column from string to date

df_apple['date'] = pd.to_datetime(df_apple['date']) # filter records after 2017

df_apple = df_apple[df_apple['date'].dt.twelvemonth > 2017] df_apple.reset_index(inplace=True)

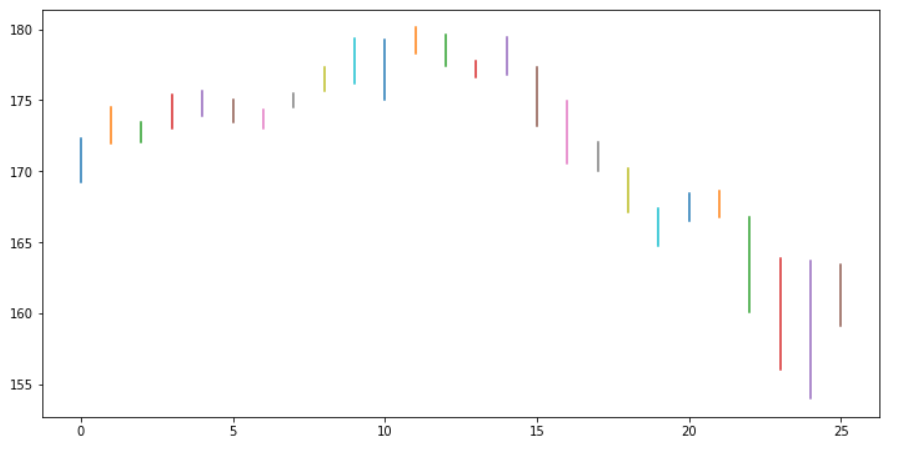

Now let's plot the sticks. They should extend from the everyman to the highest toll.

Instead of using the date as our x, nosotros'll create a NumPy array for it. That array will get from 0 to the length of our data frame. It'south easier to manipulate a numerical sequence, which will help position the sticks and the markers for open/shut prices.

To draw the lines, we'll iterate through our information frame, plotting a line for each tape of data.

x = np.arange(0,len(df_apple))

fig, ax = plt.subplots(1, figsize=(12,6)) for idx, val in df_apple.iterrows():

plt.plot([x[idx], x[idx]], [val['low'], val['high']]) plt.testify()

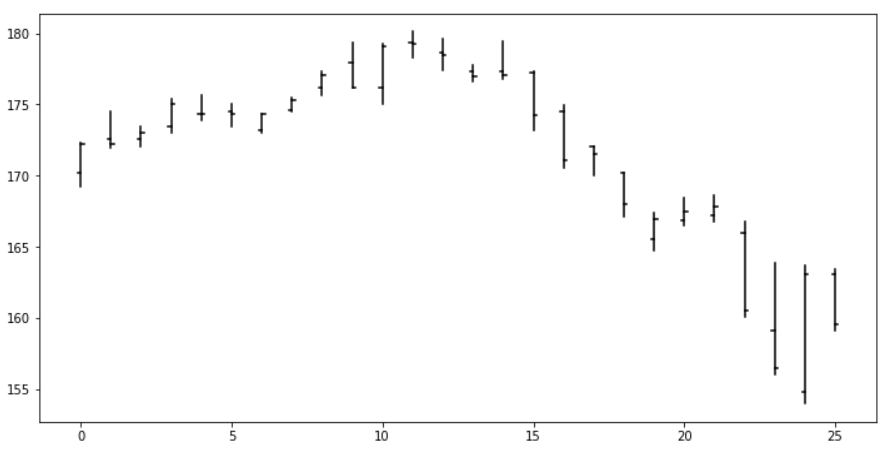

Crawly, at present nosotros can add together the markers.

10 = np.arange(0,len(df_apple))

fig, ax = plt.subplots(1, figsize=(12,6)) for idx, val in df_apple.iterrows():

# loftier/depression lines

plt.plot([x[idx], x[idx]],

[val['depression'], val['loftier']],

color='black')

# open marker

plt.plot([x[idx], ten[idx]-0.ane],

[val['open up'], val['open up']],

color='blackness')

# shut marker

plt.plot([10[idx], 10[idx]+0.1],

[val['close'], val['close']],

color='black') plt.show()

There it is! It's pretty easy to plot an OHLC chart with Matplotlib. Unlike candlesticks, you don't need colour or different fillings in the symbols to understand the visualization.

In its simplest form, this chart is readable and relatively straightforward.

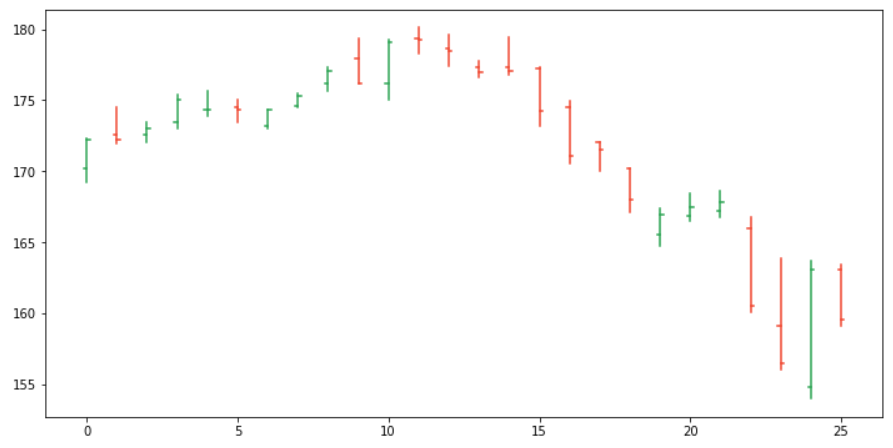

Colors

They are not necessary just can take our visualization to another level.

Nosotros'll add a variable with green color at the outset of the loop; then we'll add a condition to check if the open cost was higher than the closing price; when true, nosotros'll modify the color to red.

x = np.arange(0,len(df_apple))

fig, ax = plt.subplots(1, figsize=(12,half dozen)) for idx, val in df_apple.iterrows():

color = '#2CA453'

if val['open'] > val['close']: color= '#F04730'

plt.plot([x[idx], x[idx]],

[val['depression'], val['high']],

color=color)

plt.plot([ten[idx], x[idx]-0.ane],

[val['open'], val['open']],

colour=color)

plt.plot([10[idx], ten[idx]+0.i],

[val['close'], val['close']],

color=colour) plt.show()

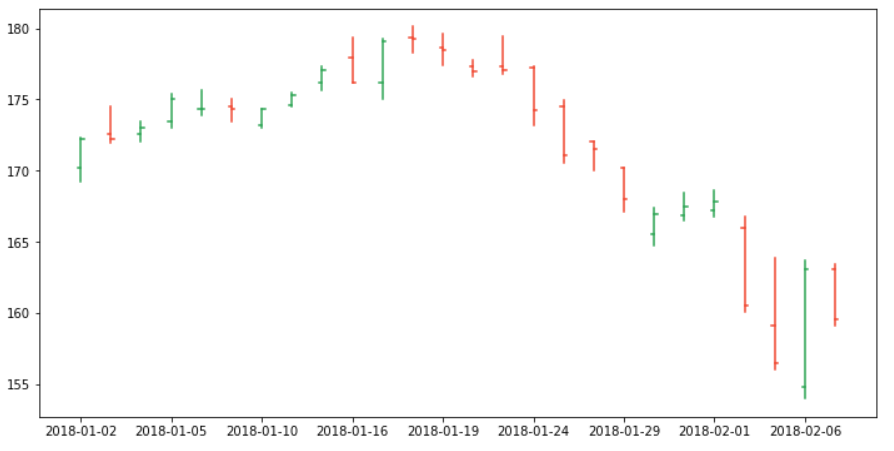

Adding color to our OHLC charts makes the past trends way more visible and our visualization more insightful.

Ticks

Our visualization already looks great, but the x-axis is useless equally it is.

Using a numerical sequence as our x helped cartoon the lines and markers, just we tin't tell the dates like this.

We'll use x to position our ticks and the dates as the labels. Nosotros likewise need to consider that if nosotros print every appointment, our x-axis will be unreadable, so we'll skip some values when plotting.

10 = np.arange(0,len(df_apple))

fig, ax = plt.subplots(1, figsize=(12,6)) for idx, val in df_apple.iterrows():

colour = '#2CA453'

if val['open'] > val['shut']: color= '#F04730'

plt.plot([x[idx], x[idx]],

[val['depression'], val['high']],

color=color)

plt.plot([x[idx], x[idx]-0.1],

[val['open'], val['open']],

color=color)

plt.plot([ten[idx], x[idx]+0.ane],

[val['close'], val['close']],

colour=color)# ticks

plt.evidence()

plt.xticks(x[::3], df_apple.date.dt.date[::3])

That's neat! Now we can add together some styling to our visualization to make information technology more highly-seasoned.

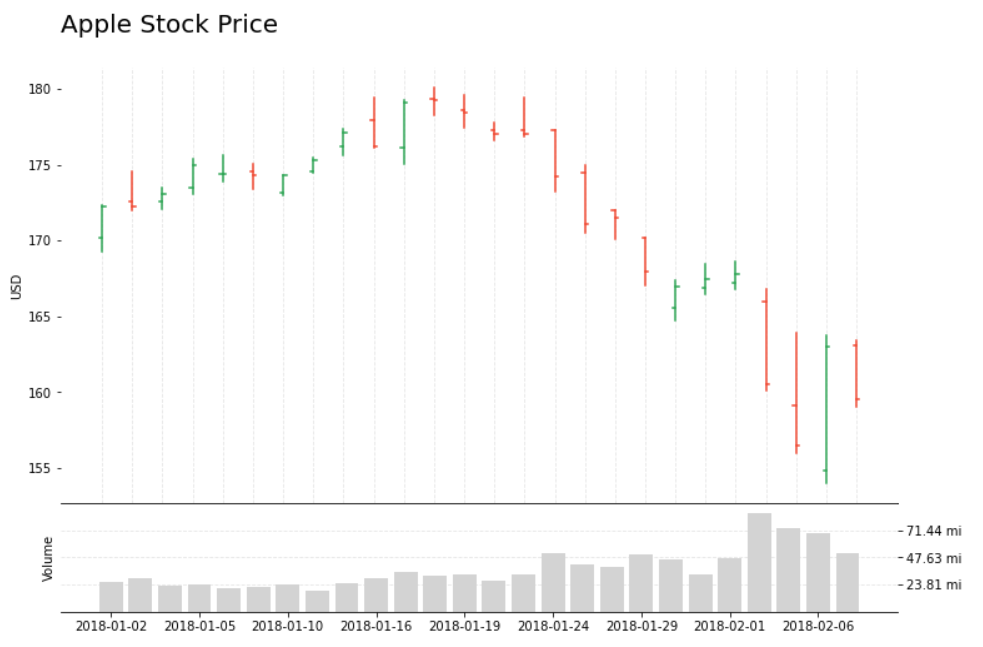

10 = np.arange(0,len(df_apple))

fig, ax = plt.subplots(1, figsize=(12,6)) for idx, val in df_apple.iterrows():

color = '#2CA453'

if val['open'] > val['close']: color= '#F04730'

plt.plot([ten[idx], ten[idx]], [val['low'], val['high']], color=color)

plt.plot([x[idx], x[idx]-0.one], [val['open'], val['open']], color=color)

plt.plot([x[idx], x[idx]+0.1], [val['shut'], val['close']], colour=color)# ticks

# labels

plt.xticks(10[::iii], df_apple.date.dt.appointment[::3])

ax.set_xticks(x, minor=True)

plt.ylabel('USD') # grid

ax.xaxis.grid(color='black', linestyle='dashed', which='both', alpha=0.1) # remove spines

ax.spines['right'].set_visible(Fake)

ax.spines['tiptop'].set_visible(False) # title

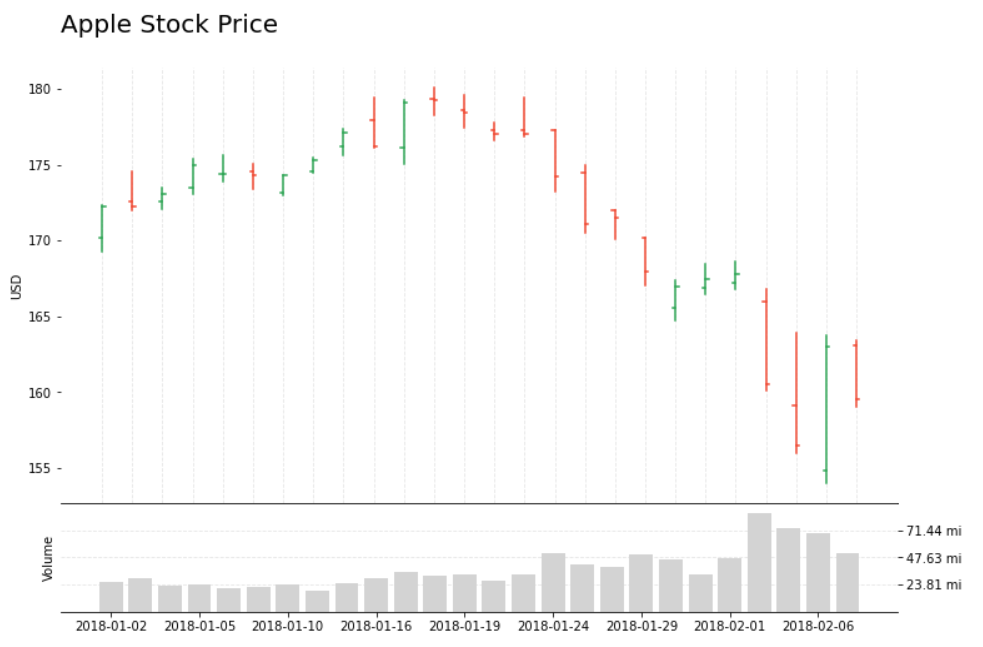

plt.title('Apple tree Stock Price', loc='left', fontsize=xx)

plt.show()

OHLC charts are a groovy starting signal for analysis since they give us a decent overview on which we can build upon.

Improving and customizing

Y'all can plot some predicted prices, confidence intervals, moving averages, trades volume, and many more than variables and statistics to complement your visualization.

Building our visualization from scratch with Matplotlib gives the states a lot of freedom.

x = np.arange(0,len(df_apple))

fig, (ax, ax2) = plt.subplots(2, figsize=(12,viii), gridspec_kw={'height_ratios': [4, one]}) for idx, val in df_apple.iterrows():

colour = '#2CA453'

if val['open'] > val['shut']: color= '#F04730'

ax.plot([x[idx], x[idx]], [val['depression'], val['high']], color=color)

ax.plot([ten[idx], ten[idx]-0.i], [val['open'], val['open']], color=color)

ax.plot([x[idx], x[idx]+0.1], [val['close'], val['close']], color=color)# ticks acme plot

# labels

ax2.set_xticks(ten[::iii])

ax2.set_xticklabels(df_apple.date.dt.date[::three])

ax.set_xticks(10, minor=True)

ax.set_ylabel('USD')

ax2.set_ylabel('Book') # grid

ax.xaxis.grid(color='black', linestyle='dashed', which='both', alpha=0.1)

ax2.set_axisbelow(True)

ax2.yaxis.grid(color='blackness', linestyle='dashed', which='both', alpha=0.1) # remove spines

ax.spines['right'].set_visible(Simulated)

ax.spines['left'].set_visible(Simulated)

ax.spines['top'].set_visible(False)

ax2.spines['right'].set_visible(False)

ax2.spines['left'].set_visible(Faux) # plot volume

ax2.bar(ten, df_apple['book'], color='lightgrey')

# go max volume + x%

mx = df_apple['volume'].max()*1.ane

# ascertain tick locations - 0 to max in 4 steps

yticks_ax2 = np.arange(0, mx+ane, mx/4)

# create labels for ticks. Supersede i.000.000 by 'mi'

yticks_labels_ax2 = ['{:.2f} mi'.format(i/million) for i in yticks_ax2]

ax2.yaxis.tick_right() # Motion ticks to the left side

# plot y ticks / skip first and final values (0 and max)

plt.yticks(yticks_ax2[1:-1], yticks_labels_ax2[1:-i])

plt.ylim(0,mx)# championship

ax.set_title('Apple Stock Price\due north', loc='left', fontsize=20)

# no spacing betwixt the subplots

plt.subplots_adjust(wspace=0, hspace=0)

plt.show()

Matplotlib Finance

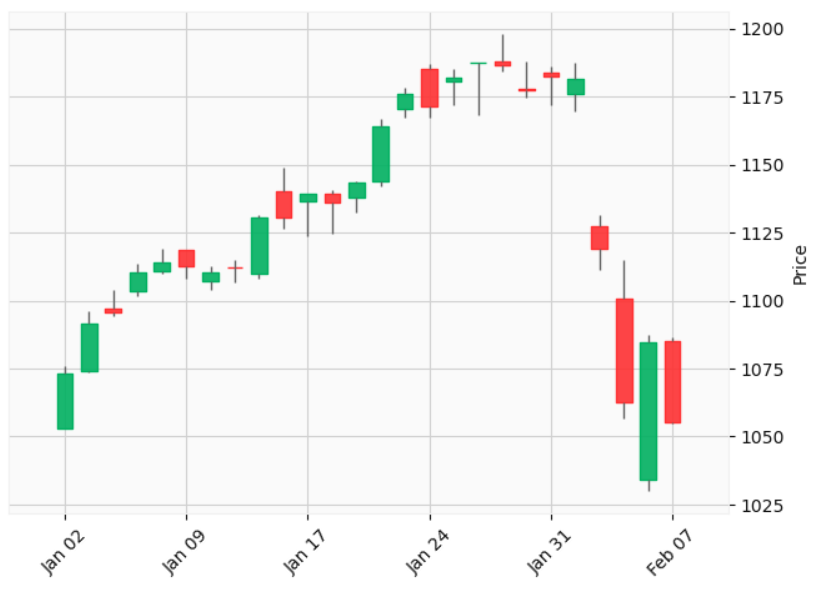

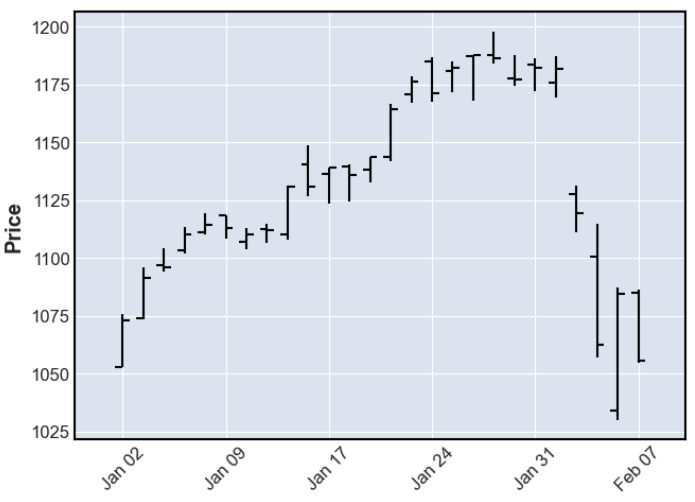

At the starting time of the article, I mentioned an easier way to plot OHLC charts. mplfinance is an excellent pack of utilities for financial visualizations.

pip install --upgrade mplfinance Let's take a look at how easy it is to use information technology.

The data frame should comprise the fields: Open, Close, Loftier, Low, and Book. Information technology also should take a DateTime index.

Our data has the proper fields, so we only need to change the index.

import mplfinance as mpf df_google = df[df['Name'] == 'GOOGL'].copy()

df_google['appointment'] = pd.to_datetime(df_google['appointment'])

df_google = df_google[df_google['date'] > pd.to_datetime('2017-12-31')]

df_google = df_google.set_index('date') mpf.plot(df_google)

Merely like that, we accept our OHLC chart!

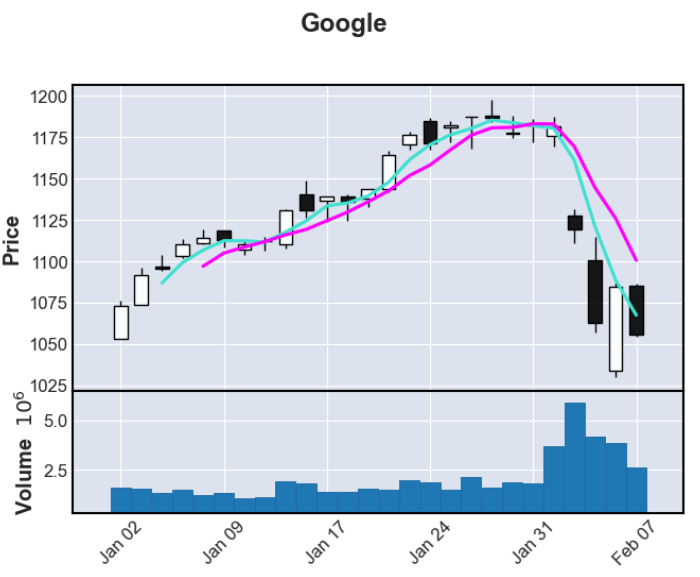

Nosotros can besides add lines for moving average and visualize the volume with a single line of lawmaking.

mpf.plot(df_google,blazon='candle',mav=(3, 5),volume=True, title='Google')

Matplotlib Finance utilities are easier to use than drawing the chart from scratch, but they are not easily customizable.

For about quick analysis, you need a functional and readable nautical chart, and mplfinance will be more than enough.

For other more specific constraints, when y'all demand to add a particular component to your visualization or customize the style to follow some blueprint standards, mplfinance may fall short.

Those are the cases where drawing the chart from scratch with Matplotlib pays off. Nosotros can hands add, change, or remove whatever office of the visualization, making it a neat tool to have under your chugalug.

Source: https://towardsdatascience.com/basics-of-ohlc-charts-with-pythons-matplotlib-56d0e745a5be

Posted by: hassourprive.blogspot.com

0 Response to "How To Use Candlestick_ohlc To Draw A Simple Candlestick On Python"

Post a Comment